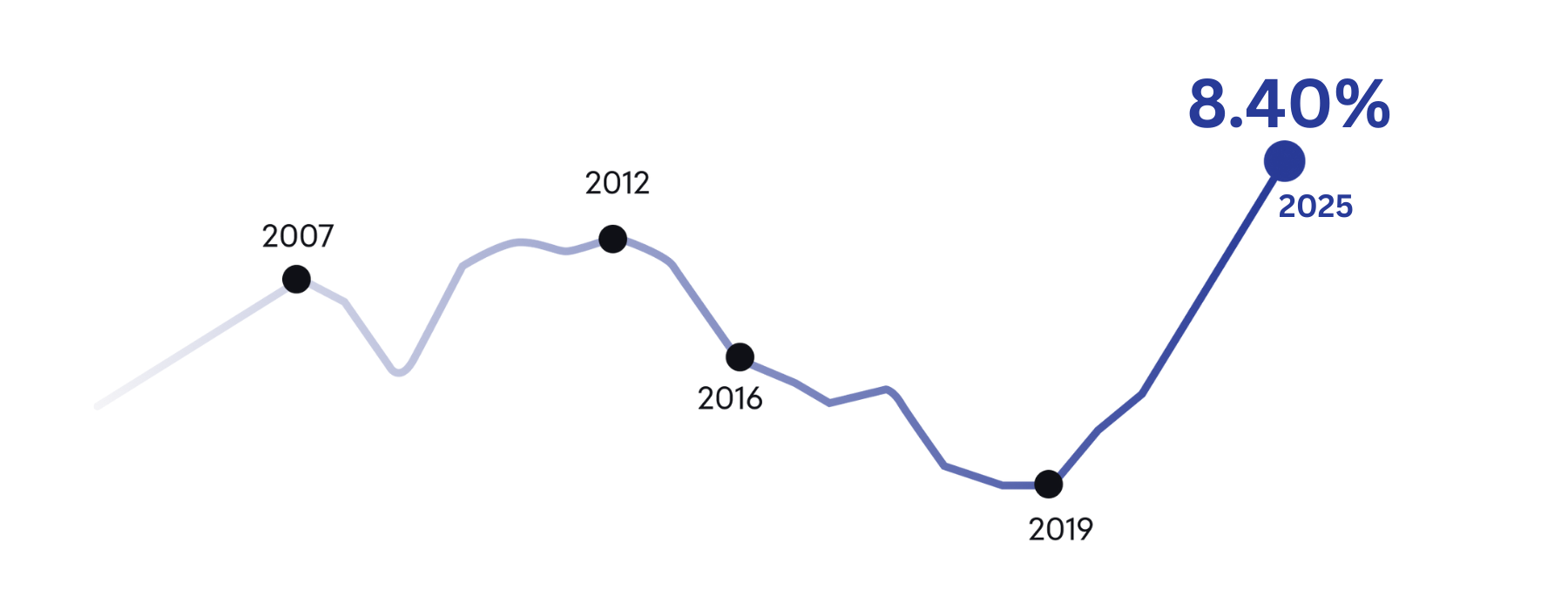

Trend Reversal

© 2025 Trend Reversal

Value Fixed Deposits

Discover premium fixed deposit solutions with fixed returns of up to 8.10% per year. Trusted FDs. Higher Returns. Complete peace of mind! Start your FD—no bank account required.

Insured By DICGC up to ₹5,00,000

Our Fixed Deposit Portfolio

Handpicked from India's most trusted financial institutions, offering you the perfect blend of security and superior returns.

Ready to maximize your returns?